National debt relief isn't a government program-it's a marketing term used by private companies. Learn how debt settlement really works, why it often backfires, and what actually helps people get out of debt without wrecking their credit.

What will $100 of Bitcoin be worth in 2030? Realistic projections show it could range from $48 to $685, depending on adoption, regulation, and market cycles. Here’s what actually matters for your investment.

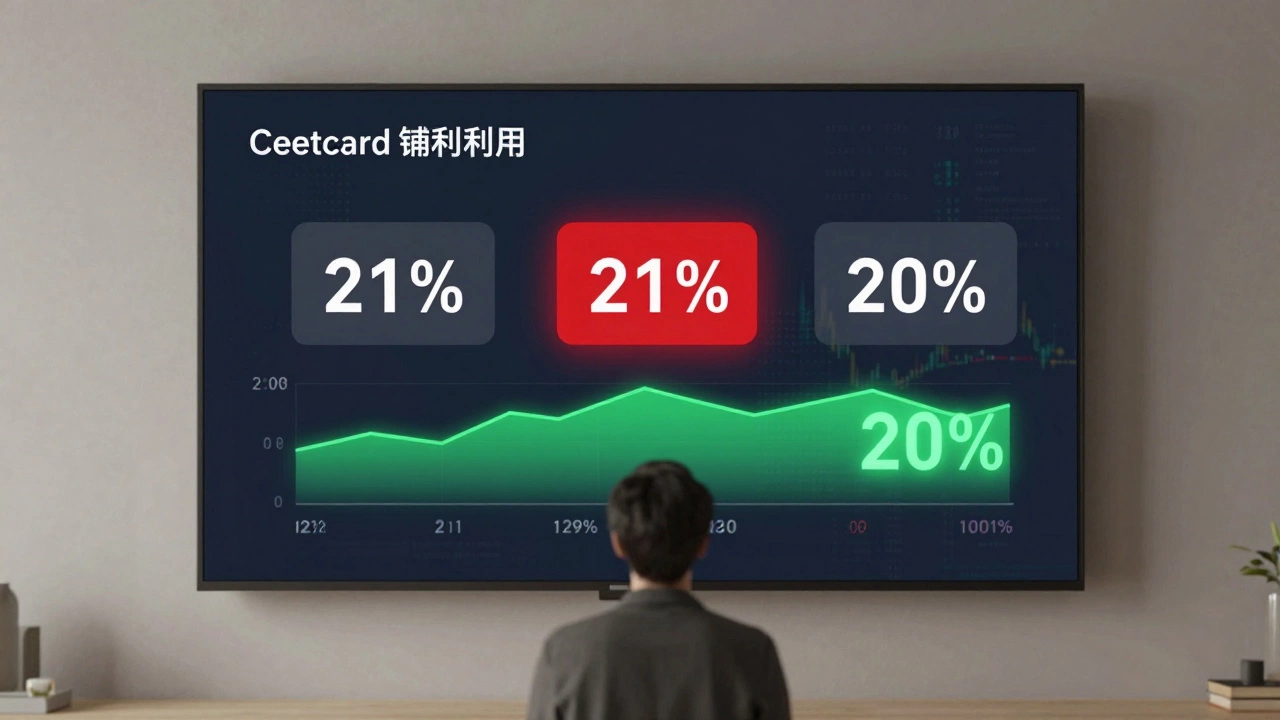

The 20% credit card rule helps you maintain a strong credit score by keeping your total credit utilization below 20%. Learn how to apply it, why it works better than the old 30% rule, and real ways to fix your utilization today.

Learn exactly how much to save each month to reach $10,000, depending on your timeline. Discover the best savings accounts in Australia, real strategies to stay on track, and how to avoid common mistakes that derail progress.

The cheapest way to take equity out of your home is usually a cash-out refinance - if you qualify. Other options like reverse mortgages cost far more. Learn the real costs, risks, and smart alternatives.

In 2026, a few Australian digital banks offer 7% interest on savings accounts-but only if you meet strict conditions. Learn who's offering it, how to qualify, and how to keep earning high returns.

Find out what credit score you need to remortgage in 2026, how different scores affect your rates, and what to do if your score is low. Learn how to improve your chances and avoid costly mistakes.

Is $2000 a good down payment on a car? In Australia, it’s the bare minimum. Learn how it affects your interest, monthly payments, and risk of being upside down on your loan-and what to do instead.

Need cash but can't get a loan? Learn practical, real ways Australians are getting emergency money without debt-from selling items and using superannuation to free community grants and gig work.

No Australian bank offers 8% interest on savings accounts. Learn the real top rates available in 2026, how to qualify, and how to avoid scams. Safe, high-interest options explained.

A $50,000 loan can cost between $584 and $1,347 per month depending on interest rate and term. Lower payments mean higher total costs. Know your rate, fees, and term before you sign.

Is 12% APR too high for a car loan in Australia? In 2026, this rate is above average and usually means you have lower credit or no down payment. Learn how to reduce costs and improve your rate.