The best time to buy a car in Australia is December, when dealers clear year-end inventory with big discounts, free registration, and low-rate finance deals. Avoid January and avoid being fooled by fake urgency.

Learn the 7 practical steps to build a real budget that works-no deprivation, no guesswork. Track spending, set goals, automate savings, and build a buffer for surprises. Take control of your money today.

Home insurance quotes typically use soft credit checks that don't affect your score. Learn how credit impacts your premium, which states ban the practice, and how to save money without hurting your credit.

Find out the safest and highest-yielding accounts for storing a large sum of money in Australia. Compare high-interest savings accounts, term deposits, and offset accounts to maximise returns without risk.

Find out exactly how much you'll have if you save $1,000 a month with today's interest rates. Compare savings accounts, CDs, and investing options for short- and long-term goals.

The 50/30/20 rule splits your after-tax income into 50% needs, 30% wants, and 20% savings/debt. It's a simple, flexible way to budget without feeling restricted. Learn how to apply it to your life and start building real financial security.

A $10,000 CD in 2025 earns about $475 in interest over a year at current rates. Learn how CD yields compare to savings accounts, where to find the best rates, and how to avoid common mistakes.

Learn the real ways to get 100% student loan forgiveness through PSLF, income-driven plans, disability discharge, and other government programs. No scams, no guesswork - just clear, actionable steps.

For a $10,000 car, aim for a $1,500 to $2,500 down payment to avoid being upside down on your loan. Lower payments, less interest, and better rates come with a stronger down payment.

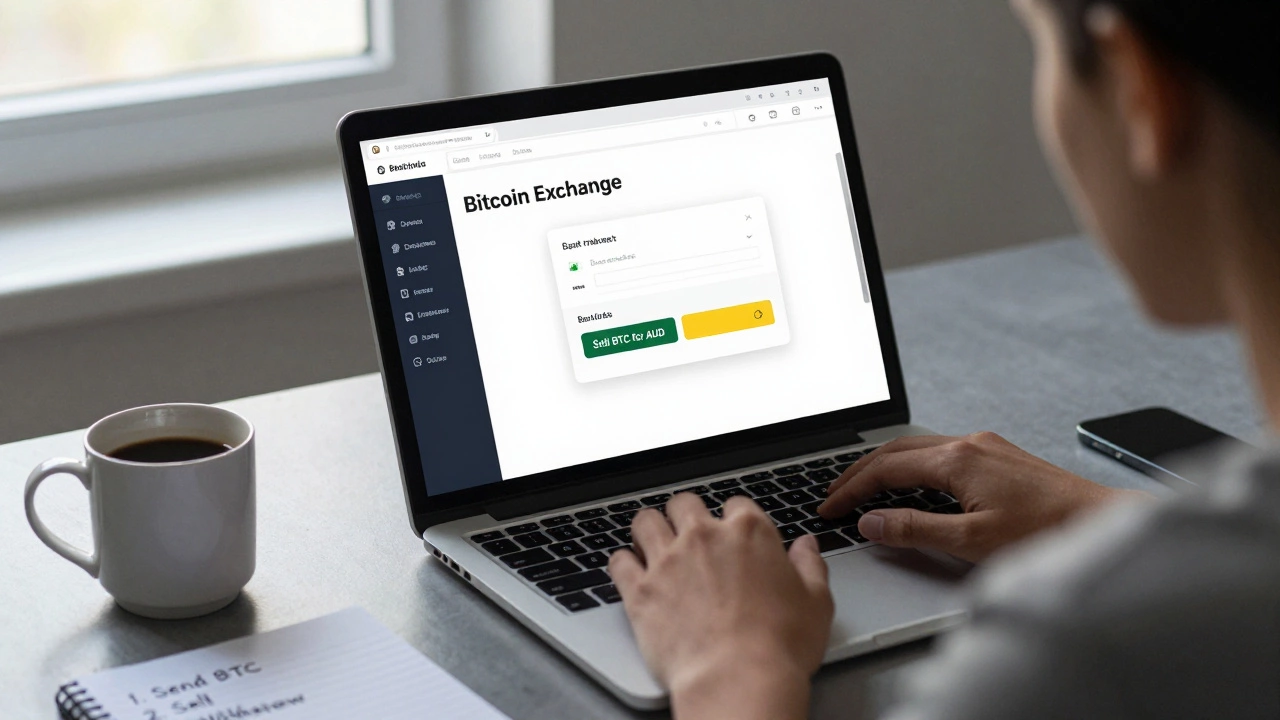

Learn how to safely convert Bitcoin into cash using trusted exchanges, ATMs, or peer-to-peer methods. Understand fees, taxes, timing, and how to avoid common mistakes when cashing out your crypto.

The average pension in the USA is around $1,907 per month from Social Security, but most retirees rely on multiple income sources. Only 15% have traditional pensions. Learn what it really takes to retire comfortably in 2025.

Withdrawing from a savings account doesn’t erase earned interest, but it can cost you future earnings-especially if you break withdrawal limits. Learn how interest works and how to keep earning more.