When managing your money in budgeting, a practical system for tracking income and spending to meet financial goals. Also known as personal finance planning, it's not about cutting out coffee—it's about making sure your money works for you instead of against you. In November 2025, people in Worcestershire were asking tough questions: Can I retire early? Is that 0% APR card really free? Should I tap into my home equity? The answers weren’t theoretical—they came from real numbers, real struggles, and real mistakes people made.

retirement planning, the process of setting income goals and saving strategies for life after work. Also known as financial independence, it’s not just about how much you save—it’s about how long it lasts. One post broke down whether $5,000 a month is enough for retirement in Australia, and the answer was: only if you own your home and don’t get hit by surprise medical bills. Another looked at retiring at 55 with $300,000—and found that location, super rules, and spending habits made all the difference. Meanwhile, equity release, a way to access cash from your home without selling it, often used by retirees. Also known as home equity loan, it’s tempting—but it grows debt over time and leaves little for your kids. People were warned: that extra cash today might mean your family gets nothing tomorrow.

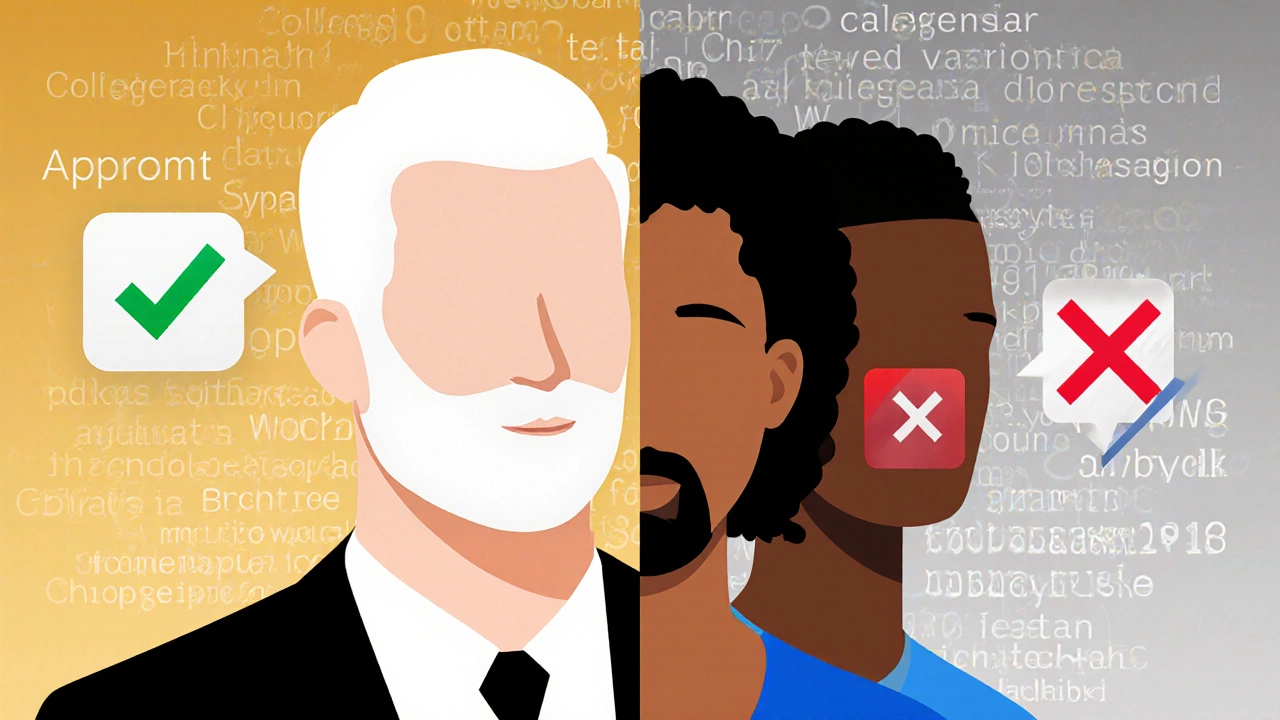

Then there’s the trap of personal loan, a fixed-sum loan used for various expenses, often with interest based on credit score. Also known as unsecured loan, it’s convenient—but algorithms can be biased. Upstart’s lawsuit wasn’t just news; it was a warning. If your loan application gets denied because of your zip code or ethnicity, that’s not just unfair—it’s systemic. And then there’s the Bitcoin investment, buying and holding digital currency as a long-term asset. Also known as cryptocurrency investment, it’s not gambling if you know how much $1,000 actually buys at $59,800 per coin. That’s not hype—that’s math.

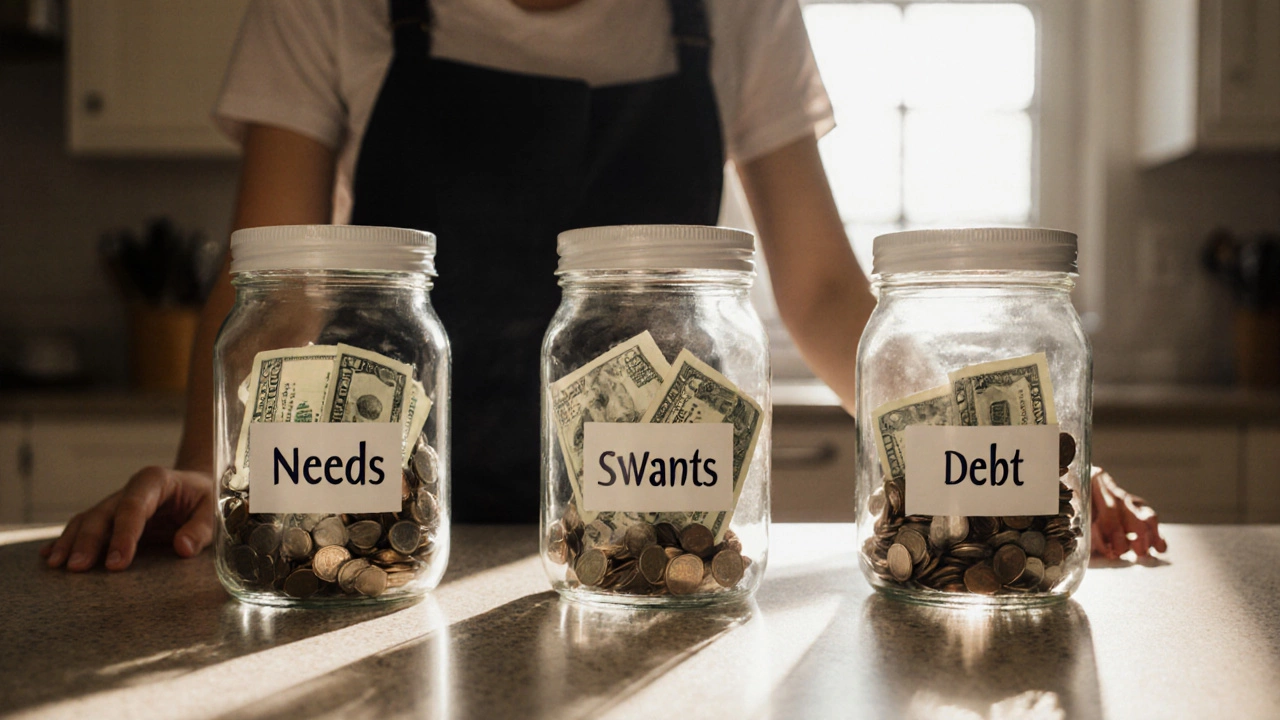

And let’s not forget the budgeting rules. The old 50-30-20 split doesn’t work in cities where rent eats half your paycheck. That’s why the 30-40-30 rule—30% needs, 40% wants, 30% savings—was gaining traction. It’s not magic. It’s just honest. You need food, you want travel, and you absolutely need to save something. No matter where you live.

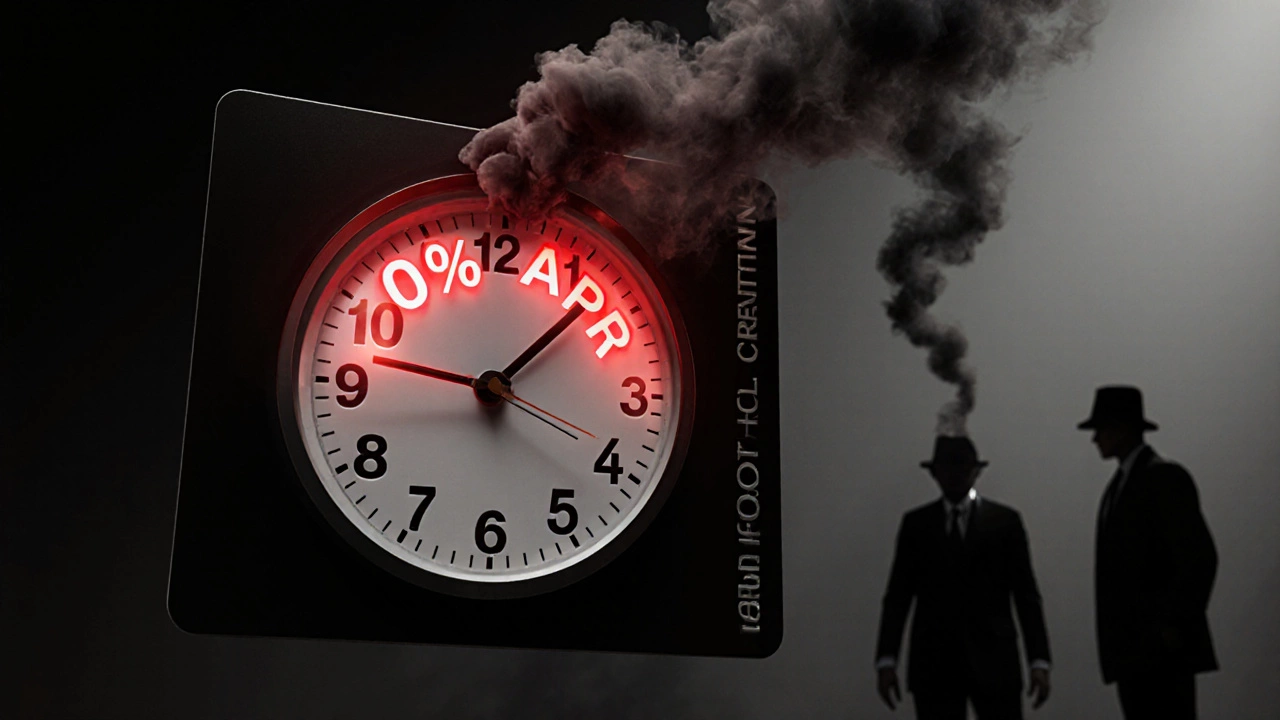

What you’ll find below isn’t a list of random articles. It’s a collection of real, actionable insights from people who’ve been there: the ones who got caught by 0% APR traps, the ones who calculated their retirement down to the pound, the ones who asked, "What if I’m wrong?" And found out before it was too late.

A good budget isn't about restriction-it's about design. Learn the three key characteristics that make budgets actually work: realism, flexibility, and action. No fluff, just what works in real life.

Upstart is being sued by the CFPB for using AI that discriminates against Black and Hispanic borrowers. Learn how its lending algorithm works, why it’s biased, and what this means for you if you’re applying for a personal loan.

0% APR credit cards seem like a dream, but hidden fees, penalties, and high interest after the promo make them dangerous. Here’s why they often trap people deeper in debt.

As of November 2025, $1000 buys about 0.0167 Bitcoin at $59,800 per coin. Learn how to buy, store, and hold Bitcoin safely - even with a small amount. No hype, just facts.

Is $5000 a month enough for retirement in Australia in 2025? Real numbers show it’s solid-but only if you own your home, plan for healthcare, and avoid hidden costs. Most retirees live on far less.

Can you retire at 55 with $300,000 in Australia? The answer depends on your location, spending habits, and whether you can access your super. This guide breaks down the real costs, super rules, and strategies to make early retirement work.

Equity release might give you cash in retirement, but it comes with hidden costs: growing debt, lost ownership, reduced pension, and little left for your family. Know the risks before you sign.

The 30-40-30 rule is a flexible budgeting method that splits your take-home pay into 30% for needs, 40% for wants, and 30% for savings and debt. It works better than 50-30-20 in high-cost cities like Sydney and helps you save without feeling deprived.