Opening an ISA costs nothing, but hidden fees, low interest, and missed opportunities can cost you thousands. Learn exactly what to watch for and how to make your ISA work for you in 2026.

In 2024, only federal student loan borrowers qualify for forgiveness through income-driven plans, public service jobs, or teaching. Private loans aren't eligible. Know the exact requirements to avoid missing out.

The best stock advice websites in 2026 deliver data-driven insights, not hype. Learn which platforms actually help investors make smarter decisions - and which ones to avoid.

Equity release lets you access your home's value without selling. But monthly interest compounds over time - and can erase your inheritance. Here’s how it works and what you can do about it.

After buying Bitcoin, the real work begins: storing it safely, deciding whether to hold or spend it, and avoiding scams. Learn how to use Bitcoin as real money, earn passive income, and protect your investment long-term.

Many Australians are denied home equity loans due to low equity, poor credit, or high debt. Learn the top reasons you might be disqualified and what steps you can take to improve your chances.

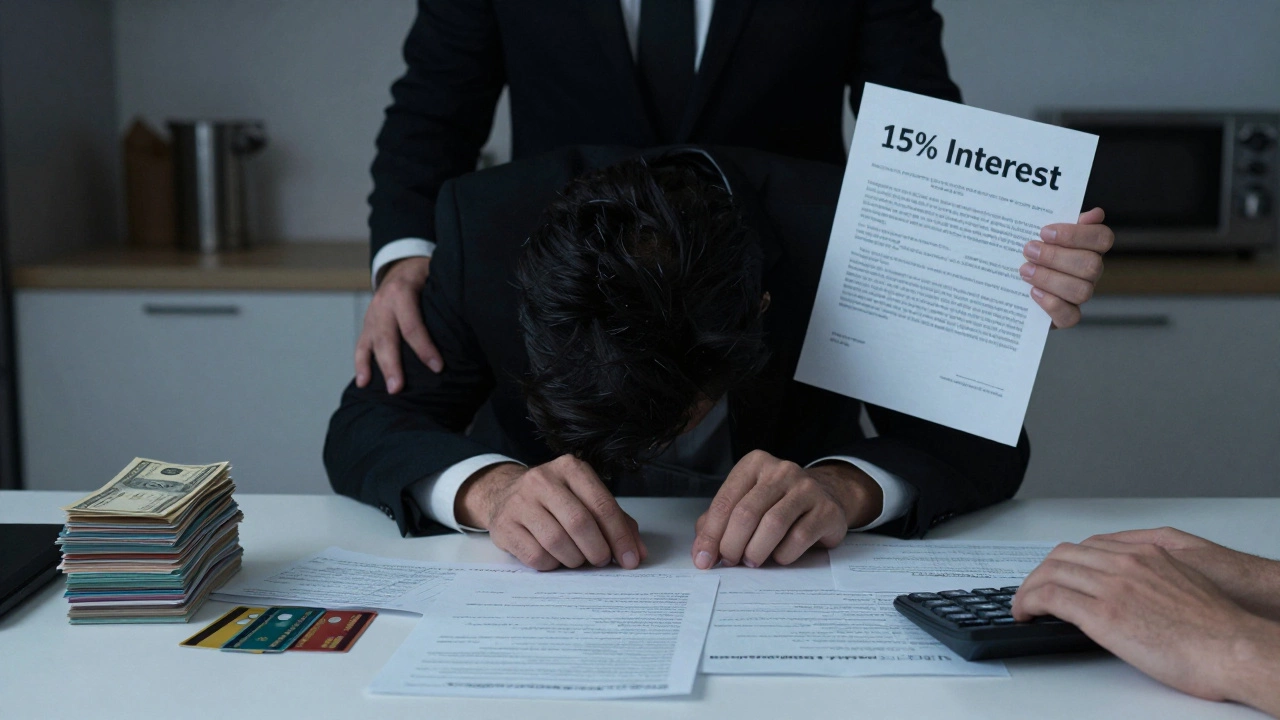

Debt consolidation seems simple but often fails due to high interest rates, strict lending rules, and unchanged spending habits. Learn why it's hard to qualify, what really works, and how to break the cycle without falling for scams.

Only 38% of Americans have $20,000 in savings. Learn why this number matters, who has it, who doesn't, and how to build your own emergency fund without a raise.

Remortgaging can give you cash, but only if you have enough equity and use it wisely. Learn how it works, what fees to expect, and when it's a smart move - or a risky one.

Taking equity out of your home might seem like an easy way to access cash, but it puts your home at risk. Rising interest rates, falling property values, and hidden fees make this a dangerous move for most Australians. Learn why protecting your equity is smarter than spending it.

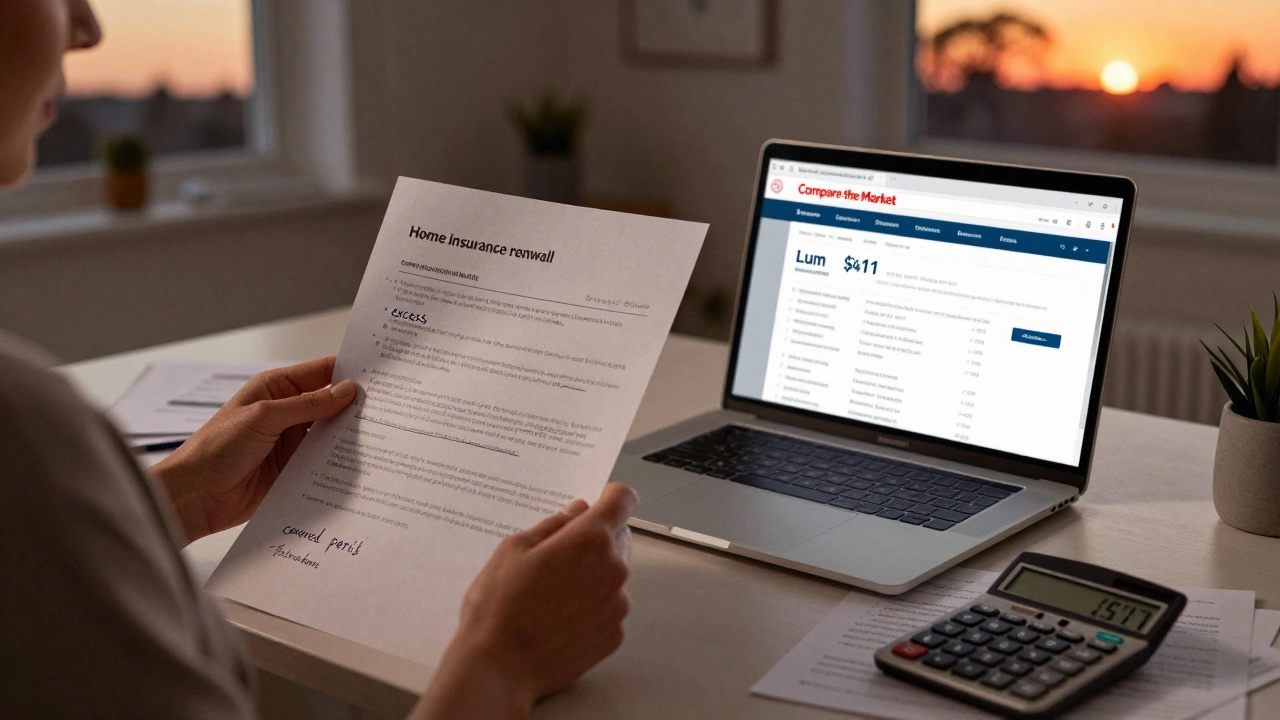

Shopping around for home insurance can save you hundreds a year. Learn how to compare policies, spot hidden costs, and switch providers without risk - with real examples from Australian homeowners.

ISA accounts let UK residents save or invest up to £20,000 a year tax-free. Learn how Cash, Stocks and Shares, and other ISA types work, how to open one, and how to avoid common mistakes.