Think life insurance is just for people with kids or big houses? Nope. Even if you're single, renting, or just starting out in your career, life insurance can cover way more than you expect. It’s all about making sure your loved ones aren’t stuck with bills or debts if something happens to you—and sometimes, it’s even a tool for building cash or paying for big life moments down the road.

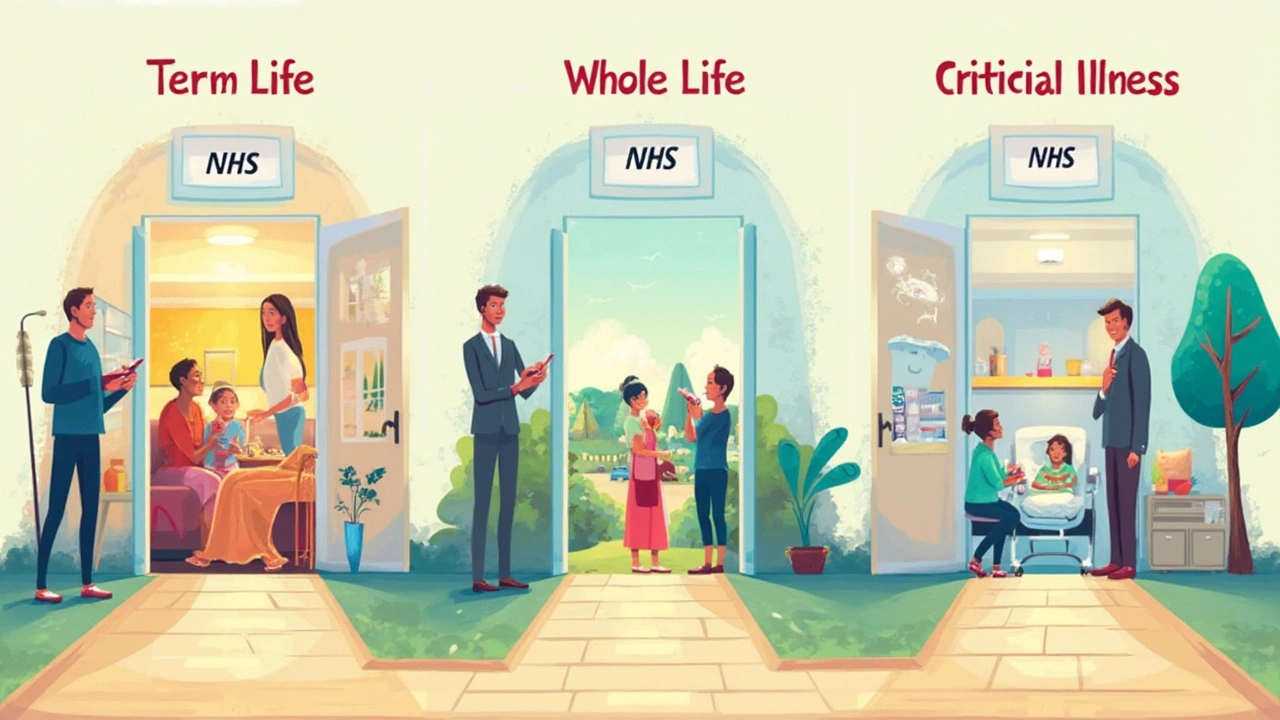

Here’s what a lot of folks miss: life insurance isn’t one-size-fits-all. Some plans cover you for a set number of years. Others last your whole life and grow in value. There’s even a type that lets you adjust both your payments and your coverage as things change. Picking the right kind saves money and headaches, especially if you know what’s hiding in the fine print.

- Why Life Insurance Matters

- Term Life Insurance: Simple and Affordable

- Whole Life Insurance: Coverage for Life

- Universal Life Insurance: Flexibility and Growth

- How to Choose What Works for You

- Smart Tips Before You Buy

Why Life Insurance Matters

Life insurance isn't just something your parents talk about—it's a real safety net. If you have family depending on your paycheck, life insurance means they’re not left struggling if you’re gone. It's not about betting on bad things happening; it's about keeping everyone afloat, no matter what.

Here’s something that catches a lot of people off guard: about 44% of adults in the U.S. own life insurance, but almost half of them think they need more coverage. People often underestimate costs like funeral bills, credit card debt, student loans, or even mortgage payments. A solid life insurance plan covers these so your loved ones don’t have to scramble during an already tough time.

- It pays off debt and covers funeral costs, which easily run over $7,000 on average in the U.S.

- It replaces lost income, so your family keeps up with rent, groceries, or utilities.

- Some policies even let you build up cash you can use for emergencies or retirement.

Check out how coverage can impact family finances:

| Scenario | With Life Insurance | Without Life Insurance |

|---|---|---|

| Paying funeral costs | Covered by policy | Paid by family savings |

| Paying off debt | Wipes out remaining loans | Family responsible for debts |

| Kids' college fund | Funds set aside from benefit | Family may struggle to save |

| Maintaining lifestyle | Income replaced for years | Possible downsizing or job change |

If you’re thinking, "But my job has some coverage," employer plans are typically small—often just one or two times your salary. They also vanish if you change jobs or get laid off. Taking control with your own plan means there are no gaps. When you break it down, life insurance is less about fear—more about being smart and prepared, just in case life throws a curveball.

Term Life Insurance: Simple and Affordable

If you just want coverage that does what it says—pays out if you pass away while the policy’s active—term life insurance is probably what you’re after. It’s the go-to choice for most people starting out or building a family. You get coverage for a set period, like 10, 20, or 30 years, and it’s almost always cheaper than other types. At the end of the term, the policy simply ends—no complicated cash value or investment stuff to figure out.

The best part? Term life is usually the most budget-friendly way to protect your family. A healthy 30-year-old can lock in $500,000 of coverage for less than $25 per month. Why so cheap? Because most policies don’t pay out—they only kick in if you die within that timeframe. If you outlive it, there’s no payout, but you’ve had peace of mind the whole way.

Here’s a quick comparison to see why term life stands out:

| Type | Average Monthly Cost (Age 30) | Covers You For | Has Cash Value? |

|---|---|---|---|

| Term Life | $25 | 10–30 years | No |

| Whole Life | $200 | Your entire life | Yes |

| Universal Life | $150 | Flexible | Yes |

If you’re buying term life insurance, here’s what to keep in mind:

- Pick a term that covers your big financial obligations. A 20- or 30-year policy works well if you’ve got a mortgage or young kids.

- Don’t just look at price. Some super-cheap policies can get tricky when it’s time to renew or convert to another type.

- If your life changes—like you start a business, get married, or have kids—revisit your coverage. Most term policies let you adjust, but only during certain windows.

Here’s a tip: some policies let you convert your life insurance to whole or universal life without another health exam. This is handy if your health changes later on. Always read the fine print so you don’t miss out on these perks.

Whole Life Insurance: Coverage for Life

This is where life insurance really starts to show off its long-term benefits. Whole life insurance sticks with you all the way—once you buy it, you’re locked in for good, as long as you keep paying your premiums. Your family’s payout is guaranteed. It doesn’t end after 10 or 20 years like term life, and your rates won’t jump as you get older or if your health changes.

One cool thing with this type of policy is its cash value feature. Part of what you pay every month goes into a kind of savings account that builds up slowly over the years. You can tap into this stash if you hit a rough patch, need a loan, or just want some extra cash later in life. You can even borrow against your policy’s value or use it to pay future premiums. Most people don’t realize it doubles as a backup financial tool, not just insurance.

- Premiums stay the same your whole life, so there are no surprises.

- Your policy won't expire if you keep up with payments—no matter what age you reach.

- Unlike term, you get a guaranteed cash payout to loved ones whenever you pass, whether you’re 70 or 105.

- Building cash value gives you options: emergency funds, retirement planning, or major purchases.

Whole life tends to cost more at the start than term insurance, but that price locks in forever. You pay for the security, investment perks, and knowing your family always gets a payout.

| Feature | Term Life | Whole Life |

|---|---|---|

| Coverage Period | 10-30 years | Lifetime |

| Builds Cash Value | No | Yes |

| Payout Guarantee | Only if you die during term | Guaranteed |

| Premium Cost | Lower at first | Higher, but fixed |

Not everyone needs whole life insurance—if you’re focused on just covering debts or your kid’s college, term might work better. But if you want lifelong coverage that also acts as a money tool, whole life could be the move. Just compare costs and think about how much flexibility matters to you. If lifelong security and savings sound good, whole life insurance is worth a close look.

Universal Life Insurance: Flexibility and Growth

If you hate being boxed in, universal life insurance might actually feel like a breath of fresh air. Unlike term or whole life, this one gives you more control over both your payments and how much coverage you own. You can pay a bigger premium some months, or just cover the basics if cash is tight. It’s the Swiss Army knife of life insurance.

At its core, universal life insurance splits your payment two ways—one part covers your chosen death benefit, and the other part goes into a kind of savings account. This savings bit (called the “cash value”) earns interest, usually at a rate set by your insurer. Some plans even let you invest that cash value for higher growth. You can dip into your cash value or even use it to cover premiums if you hit a rough patch financially.

Here’s a quick comparison to make it clearer:

| Feature | Universal Life Insurance | Term Life | Whole Life |

|---|---|---|---|

| Coverage Length | Flexible/lifetime | Set term (10-30 years) | Lifetime |

| Premiums | Flexible | Fixed | Fixed |

| Cash Value | Yes (grows over time) | No | Yes (grows steadily) |

| Can Borrow Against Value? | Yes | No | Yes |

According to the Life Insurance Marketing and Research Association (LIMRA), about 10 million American households owned some form of universal life insurance in 2023. Why? Flexible payments and the cash value feature make it attractive, especially for folks with changing incomes or goals.

Thinking about using universal life insurance? Here’s when it comes in handy:

- Your income goes up and down, so you want to pay more some years, less other years.

- You like the idea of building extra savings inside your policy—kind of like a backup plan.

- You may want to borrow against the cash value for emergencies, college, or even a side hustle.

- Your needs might change—like coverage for kids or grandkids—or you want the option to boost your death benefit down the line.

If you like flexibility and plan to keep your policy for the long haul, life insurance like this can make a lot of sense. Just don’t forget: the more you pay in, the more cash value grows—and investing that cash does come with some risk and fine print. Always read the details before you sign up.

How to Choose What Works for You

Picking the right life insurance isn’t about grabbing the first policy you see. It’s about matching what you actually need to what you’re paying for. Everyone’s life is different—so your insurance should be, too.

First, ask yourself: Is this coverage for your family’s living expenses if you’re gone? Is it about handling your mortgage or debt? Or maybe you want to leave a chunk of money for your kids’ college or your partner’s retirement. Nail down exactly what you’re covering before shopping around.

- If you want coverage for just a certain period—like while paying off a mortgage or raising kids—term life is usually the cheapest and easiest. Most people under 40 with young families start here because it gives a big payout for a small price.

- If you want something that lasts your whole life and builds cash for emergencies, whole life might be your thing. Just know—it costs a lot more, but you get both insurance and a savings account in one.

- Need flexibility, with options to change your payments or death benefit as your life shifts? Universal life is for that. Great if your income or needs might go up and down, like for business owners or anyone not sure what the next 10 years look like.

Be honest about your budget. If cash is tight, it’s better to have some coverage now than to wait until you can afford a fancy plan. Term policies can be dirt cheap if you’re young and healthy—even less than your weekly coffee run.

Don’t forget to check if your job offers free or discounted group coverage. Just remember: most group policies aren’t portable. If you switch jobs, you might be left uncovered.

Always compare quotes from at least three big-name companies. Policy costs can be all over the map, and some insurers tack extras on without telling you. Read the details—especially the part about what’s not covered.

Last tip—review your policy whenever big life stuff happens, like getting married, having a kid, or buying a house. Your needs change, and so should your insurance. That’s how you really make it work for you.

Smart Tips Before You Buy

Getting life insurance isn’t just about picking a monthly price that ‘feels right’ and hoping for the best. There are a few things you should always check before signing anything. This way, you’ll know what you’re paying for—and avoid surprises later.

- Life insurance prices don’t always go up with more coverage. Sometimes, bumping up your policy a bit barely changes your monthly cost. It’s smart to compare quotes at different amounts, not just the bare minimum.

- Always look at the policy’s exclusions. Some plans won’t pay if you die certain ways (like risky hobbies or travel), and yes, these exclusions do pop up in real claims.

- If your job gives you free basic coverage, that’s cool, but it usually isn’t enough. Most work plans only pay one or two years’ salary—and if you leave the job, the coverage disappears. Always double-check if you can keep that plan if you switch jobs.

- Age matters—a lot. Buying when you’re young and relatively healthy can lock in super low rates, sometimes for decades. Waiting just five years can cost way more. The cheapest time to get covered is almost always today, not tomorrow.

- Shop around and get at least three quotes. One company might charge way more for the same thing, especially if your health isn’t perfect. Small health details, like your driving record or blood pressure, can make a huge difference in price between companies.

- Ask if the policy drops your rate if your health improves. Some modern plans will lower your monthly payment if you quit smoking or lose weight after buying the plan.

And here’s one last thing: always check the company’s financial ratings. A well-rated insurer is more likely to pay out—and quickly—when your loved ones need the money. Sites like A.M. Best or Moody’s make this easy to check with a quick search.