Pension vs 401(k) Retirement Plan Comparison Tool

Pension (Defined Benefit)

A guaranteed retirement income based on salary and years of service. Employer bears the investment risk.

- Guaranteed monthly benefit

- Employer-funded

- Limited portability

- No investment decisions needed

401(k) (Defined Contribution)

Contributions invested in various funds with potential for growth. Employee controls investment choices.

- Depends on contributions and investment returns

- Employee + optional employer contributions

- Highly portable

- Employee bears investment risk

Your Retirement Profile

Recommended Plan Based on Your Profile

Complete your profile to see personalized recommendations between Pension and 401(k) options.

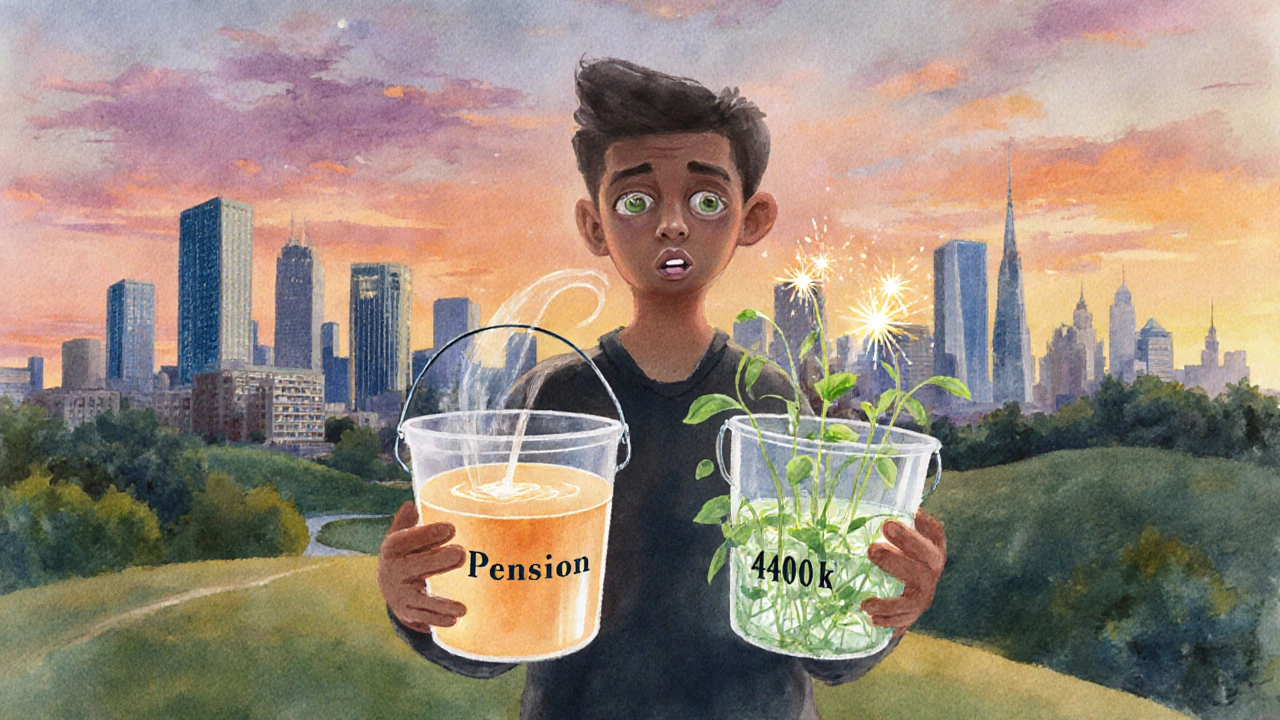

When you’re planning for the years after work, the biggest question often boils down to a simple comparison: pension vs 401k. Both aim to give you a steady income in retirement, but they work in totally different ways. Understanding those differences lets you decide which one fits your career path, risk tolerance, and long‑term goals.

What a pension actually is

Pension is a defined‑benefit retirement plan where an employer promises a specific monthly benefit based on salary and years of service. The promise is usually backed by actuarial calculations and, in many cases, insurance guarantees.

Pensions have been around for decades and were once the default retirement product for most large employers. They’re typically funded by the employer, sometimes with a small employee contribution, and the payout is guaranteed regardless of market performance.

What a 401(k) actually is

401(k) is a defined‑contribution plan that lets employees set aside pre‑tax dollars, often matched by the employer, and invest them in a choice of funds. The account balance depends entirely on contributions and investment returns.

Introduced in the early 1980s, the 401(k) quickly became the main retirement vehicle for private‑sector workers in the United States. The employee controls where the money goes, but the risk of market swings stays with the employee.

Core differences at a glance

| Feature | Pension (Defined Benefit) | 401(k) (Defined Contribution) |

|---|---|---|

| Funding source | Primarily employer‑paid | Employee‑paid (pre‑tax) + optional employer match |

| Benefit predictability | Guaranteed monthly benefit | Depends on contributions and market performance |

| Portability | Limited - usually stays with the employer | Highly portable - roll over to new employer or IRA |

| Investment control | None - plan manager invests | Employee selects from offered investment options |

| Tax treatment | Pre‑tax contributions, taxed as ordinary income on payout | Pre‑tax contributions, taxed on withdrawal; Roth option available for after‑tax contributions |

| Risk bearing | Employer bears investment risk | Employee bears investment risk |

| Contribution limits | No annual caps; benefit formula determines payout | Annual limit set by IRS (e.g., $22,500 for 2024, plus catch‑up |

| Early withdrawal rules | Usually not allowed before retirement age, except in hardship cases | Penalty of 10% + income tax if taken before 59½ (exceptions apply) |

Pros and cons of a pension

Defined‑benefit plans offer a safety net that many younger workers find comforting. The biggest advantage is predictability - you know exactly what you’ll receive each month, which makes budgeting for retirement simple.

- Stability: Payments continue even if the stock market tanks.

- No investment decisions: You don’t have to pick funds or worry about fees.

- Employer‑borne risk: The company shoulders actuarial and market risk.

On the flip side, pensions can be inflexible.

- Limited portability: If you change jobs, you may lose accrued benefits or have to wait years to vest.

- Potential underfunding: Some companies struggle to meet future obligations, which could reduce promised benefits.

- Lack of growth upside: You won’t benefit from a booming market.

Pros and cons of a 401(k)

Because a defined‑contribution plan puts the control in your hands, you can shape retirement savings to match your risk tolerance.

- Portability: Roll over to a new employer’s plan or an IRA without penalties.

- Potential for higher returns: Market gains directly increase your balance.

- Employer matching: Many companies match a portion of contributions, effectively adding free money.

- Roth option: After‑tax contributions grow tax‑free.

But the power comes with responsibility.

- Investment risk: Bad market performance can shrink your nest egg.

- Fees: Management fees and expense ratios can erode returns over time.

- Contribution limits: IRS caps constrain how much you can stash each year.

When a pension might be the better choice

If you value certainty and plan to stay with one employer for a long stretch, a pension often wins. Public‑sector workers, teachers, and unionized employees frequently receive generous defined‑benefit plans that pay out a sizable annuity. In such cases, the guaranteed income can serve as a core part of your retirement budget, letting you allocate other savings to more flexible accounts.

People approaching retirement who lack confidence in market timing also benefit from the safety net a pension provides. The predictable cash flow helps cover essential expenses like housing, healthcare, and utilities without the need to monitor investment performance daily.

When a 401(k) might be the better choice

If you expect multiple job changes, work for a startup, or want to maximize growth potential, a 401(k) typically edges out a pension. Younger professionals who have decades before retirement can let compounding work in their favor, especially when their employer offers a solid match (e.g., 5% of salary). The Roth 401(k) variant is especially attractive for those who anticipate being in a higher tax bracket later.

Those who enjoy hands‑on investing and want the ability to adjust asset allocation as life circumstances shift will also prefer a 401(k). The plan’s flexibility lets you increase contributions when cash flow improves or shift to conservative investments as retirement nears.

How to decide for yourself - a quick checklist

- Identify your employment situation: Are you likely to stay with one employer for 10+ years?

- Gauge your comfort with market risk: Do you prefer a set payout or are you okay with fluctuations?

- Check employer benefits: Does your company match 401(k) contributions? Does it offer a pension?

- Consider tax strategy: Will a pre‑tax 401(k) or a Roth option suit your projected retirement tax rate?

- Plan for portability: If you anticipate relocation or career changes, a 401(k) offers more flexibility.

- Look at fee structures: Compare expense ratios of 401(k) investment options against the hidden costs of a pension (administrative fees, potential underfunding).

- Project retirement income needs: Use the pension’s guaranteed amount as a baseline, then layer a 401(k) to boost lifestyle spending.

Running these points through a spreadsheet or a retirement calculator can give a clear visual of how each option impacts your future cash flow.

Combining both - a hybrid approach

Many workers don’t have to pick one over the other. If your employer offers both, treat the pension as the foundation of your retirement budget and use the 401(k) to supplement. The pension’s guaranteed income covers essential expenses, while the 401(k) provides growth potential for discretionary spending, travel, or unexpected costs.

Even if you only have a 401(k) now, you can still simulate a pension‑like safety net by adopting a “bucket” strategy: allocate a portion of your portfolio to low‑risk, income‑generating assets (e.g., short‑term bonds, dividend ETFs) as you near retirement. This mimics the steady payout of a defined‑benefit plan without sacrificing the early‑career growth advantages.

Key takeaways

- Pensions offer guaranteed income, low personal risk, but limited portability.

- 401(k)s give control, higher growth upside, and easy rollovers, but you bear investment risk.

- Your career path, risk appetite, and tax outlook determine which option-or combination-fits best.

Frequently Asked Questions

Can I transfer a pension into a 401(k)?

Direct transfers are rare. In most cases you can roll a qualified pension into an IRA after you leave the employer, then move the IRA into a 401(k) if the plan accepts rollovers. Always check the plan’s rules and consult a tax advisor to avoid penalties.

What happens to my pension if my company goes bankrupt?

Many private‑sector pensions are insured by the Pension Benefit Guaranty Corporation (PBGC). If the plan fails, PBGC steps in to pay a portion of the promised benefits, subject to legal limits. Public‑sector pensions are usually protected by state laws.

Are 401(k) contributions taxed before or after I earn them?

Traditional 401(k) contributions are made pre‑tax, reducing your taxable income for the year. Roth 401(k) contributions are after‑tax, meaning you pay income tax now and qualified withdrawals are tax‑free.

Which option typically has higher fees?

Pensions usually have lower explicit fees because they’re managed by the employer’s trustee. 401(k) fees vary widely; low‑cost index funds can be under 0.10%, while actively managed options may exceed 1% annually. Always read the plan’s fee disclosure.

Can I withdraw money from a 401(k) before age 59½ without penalty?

Yes, but only under certain circumstances: hardship withdrawals, qualified birth or adoption expenses, or if you separate from service after age 55. Otherwise a 10% early‑withdrawal penalty plus income tax applies.